Understanding how e-file 2290 helps reduce errors and save time

Understanding how e-file 2290 helps reduce errors and save time

Blog Article

I have discovered that many people with the talent and drive to start their own business seldom have the education and tools required to satisfy the bookkeeping requirements for their venture. Therefore, I have compiled this article to help those who may be confused on some of the issues.

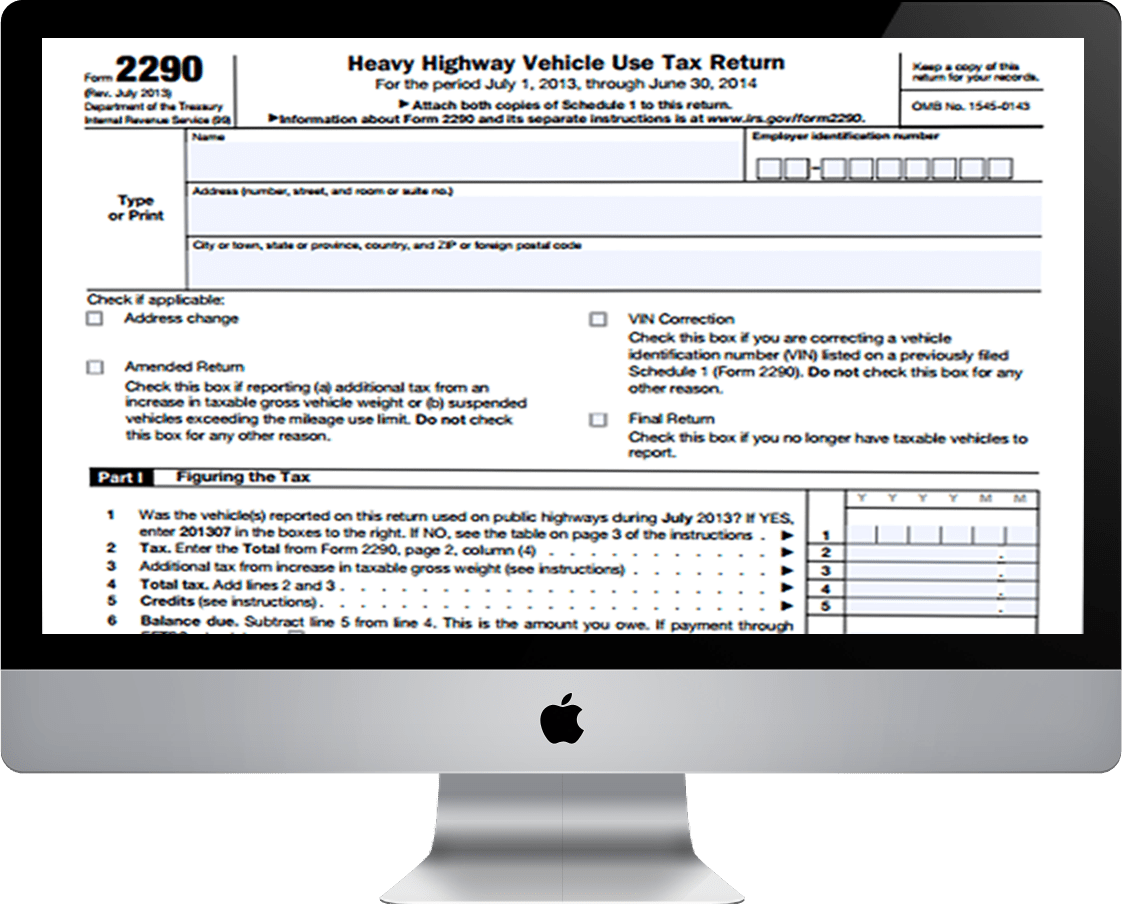

Time plays an important role in the trucking business. If you cannot meet your deadlines, there will be some sorely disappointed customers waiting on the other end. The filing of Form 2290 for trucks was usually done at the Internal Revenue Service office. In 2008, however, the electronic 2290 tax form form was introduced.

Get Form 2290 online Your Email Marketing System setup. This is one of the most important steps in becoming an effective and efficient business builder. Those who do not understand prospecting think that they need thousands of leads in order to be successful. Note pads, spread sheets etc... is not a good way to manage your leads. Once you see and understand how a good contact management program can simplify your life by making you more effective and productive you'll wonder how you ever got along without your second brain. My recommended email marketing system can give you access to a contact management system to store your leads.

He played college football on scholarship for four years and competed in three drug-free bodybuilding contests. Currently he competes in the Police Olympics, which consist of swimming, a 5K run, a 100m sprint, throwing a shot put, the rope climb, and the bench press. Personally he is training for an adventure race, which consists of mountain biking, canoeing, and a run.

Before you move to Mexico, or if you have already relocated to Mexico, you must check with the U.S. state from which you expatriated for their specific IRS heavy vehicle tax laws.

The tax account transcript is the best of the two because it will include any adjustments that were made after you filed. The type of information included are your adjusted gross income, taxable income, your marital status and whether you filed a long or short form 1040.

The IRS has years of experience and teams of people working to ensure that the taxpayer is compliant and understands their legal obligation. That being the case you need to ask yourself this question: Is it worth the risk to save a couple of thousand dollars when I go into the lions den? I assure you it is not. Whether you agree with the notion of IRS 2290 filing charging someone for representation before the IRS, and whether you can afford it, is not the real question. The real question is can you afford not to?